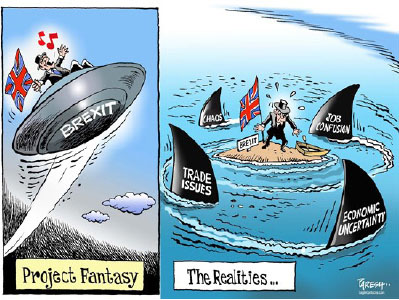

This past June, the United Kingdom voted to leave the European Union, resulting in immense political and economic changes across the world. With 51.9 percent of votes in favor of the referendum, the majority of U.K. citizens dim-wittingly overlooked the immediate consequences of separating themselves from the rest of the European continent. However, during these last few months, more disastrous “long-term” repercussions have begun to surface.

The U.K. must do all it can to reverse itself and to remain in the European Union.

According to the finance industry group TheCityUK, the United Kingdom’s finance sector may be facing losses upwards of $48.34 billion in revenue. This economic blow, dubbed a “hard Brexit,” could prevent finance firms from freely bartering their services to neighboring nations. Although a seemingly-obvious outcome of leaving the Union, both British MPs and citizens were blinded by false statistics and inflated pride, ultimately failing to consider future alternatives from the European Union’s single market.

Withal, the question remains “who exactly is to blame for such a catastrophe?”

The answer to this is simple: the Tories.

Take Boris Johnson, who paraded around in a bus with the words “We send the EU £350 million a week.” In reality, that number is closer to £190 million. This granted the U.K. a plethora of benefits, including unrestrained citizenry to work and travel across borders. Now the British government may have to pay just that — if not more — to access the common market.

The majority of parliament still remains stoic on its stance on leaving. Their irrational stubbornness anchors solely on the belief that exiting will allow the British people to have more control over their own fate — a gratuitous excuse to justify a blatant mistake. London-based businesses are, however, heeding to the quarter-by-quarter drops, moving operations to places elsewhere in Europe.

And rightfully so.

Innocent companies have no reason to intertwine their futures with the U.K.’s downfall. If anything, it is their fundamental right to separate themselves from the nation’s toxic uncertainty, prolonged low interest rates, and volume losses.

The fallout of Britain’s stupidity is evident today, as more than 75,000 jobs are at risk of being lost. Furthermore, in a report by consultancy firm Oliver Wyman, the British government is on track to losing over $12 billion in tax revenues.

Yet still, a handful of ministers are desperately trying to clean up the mess by negotiating a deal with Brussels that will outline future relations with Europe. Unfortunately, because of new Prime Minister Theresa May’s initiation of Article 50, triggering the official beginning of Brexit, the entire arbitration process may not be completed until at the very least 2019.

In addition, the EU leadership’s unprofessional animosity towards the U.K. decision to leave will most certainly force the nation to follow World Trade Organization regulations.

“The feeling among the EuropBut besides the 31-year low value of the pound, the effects of Brexit may hint at a more ominous consequence: the collapse of the British economy. As selling services, financial and otherwise, accounts for roughly 78 percent of the British GDP, WTO restrictions on these suppliers will significantly downsize the economy. Before foreign investors could freely rely on a British firm for financial consultancy, they now face a glut of regulations — which will further scare away the sector’s European customer base.

This loss of such concentrated fiscal activity will not only knock the U.K. from being an international hub for financial services but also permanently cripple London.

Britain must find a new “financial passport” system if it hopes to continue trading with the rest of the continent. And unless the British public discards its sentiment towards the European Union, the entirety of the UK economy will be decimated.