By Mwendwawangai Daisley ’24

In recent weeks, the financial world has been abuzz with news of Chinese real estate giant Evergrande teetering on the edge of collapse. While the Evergrande saga has been extensively covered, it is imperative that we examine this crisis in the context of broader issues surrounding debt.

Evergrande’s staggering debt load, estimated at around $300 billion, has cast a long shadow over China’s property market and sent shockwaves throughout global financial markets. The once-mighty conglomerate is grappling with a debt crisis of unprecedented proportions, and the consequences could reverberate far beyond China’s borders.

Evergrande’s plight is a stark reminder of the perils of excessive leverage, when too much debt impedes a company’s ability to cover operating expenses. Massive borrowing fueled the company’s rapid expansion, leading to an unsustainable debt burden. This situation, while extreme, mirrors a trend seen across the corporate landscape worldwide: companies, governments, and individuals often find themselves drowning in debt as they chase profit regardless of the implications.

The unfolding crisis forces a confrontation of some uncomfortable truths about the interconnectedness of the global financial system. International investors, including major banks and bondholders, are closely tied to the fate of Evergrande, as they encouraged reckless borrowing and mindless spending. This interdependence underscores the increasing need for vigilance and caution.

Moreover, the Chinese government’s response to the Evergrande crisis reveals the delicate balance between managing systemic risks and maintaining economic stability. For the past few years, the Chinese government has restricted media coverage surrounding Evergrande in an attempt to squander investor uncertainty, all while encouraging a gradual dismemberment of Evergrande’s assets in an attempt to repay its sizable debts.

Still, this easured response prompts us to question how governments worldwide address financial crises, with their actions having far-reaching implications for citizens and markets alike. The Evergrande crisis is more than just a cautionary tale about a single corporation’s downfall. It is a microcosm of the broader issues surrounding debt in the modern world.

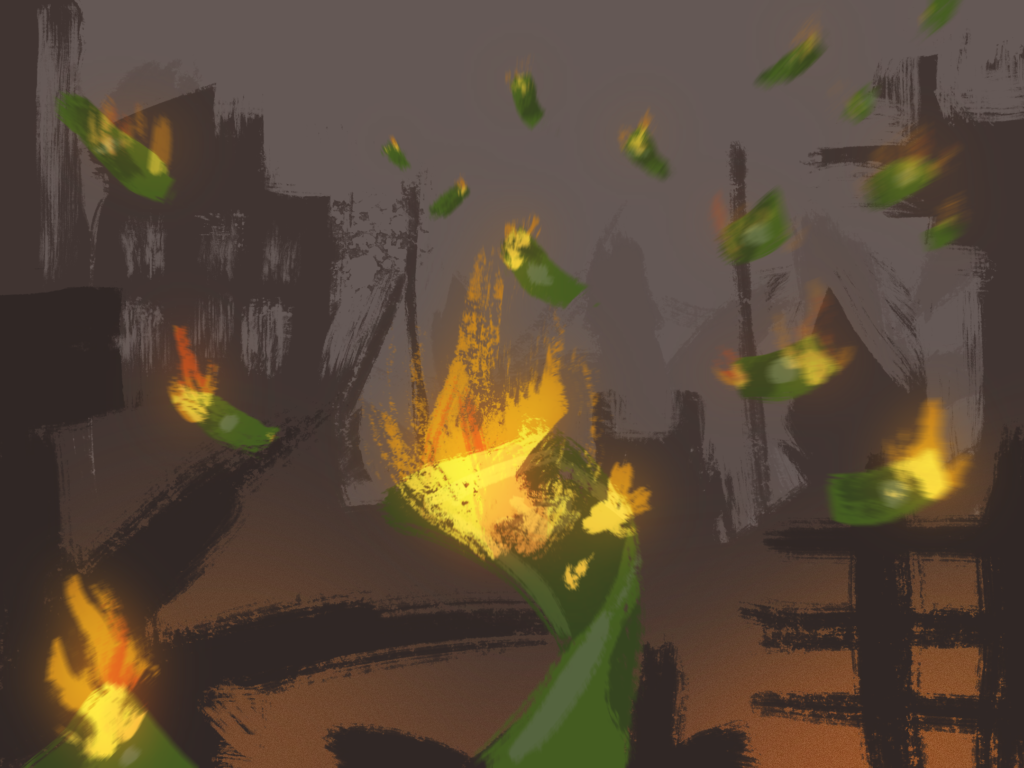

The Evergrande debacle serves as a sobering reminder of the global debt landscape. Borrowing is a double-edged sword; it can fund growth and prosperity, but when left unchecked, it can lead to catastrophic consequences. The allure of easy credit creates a honey trap seducing individuals, corporations, and governments, resulting in a debt-fueled global economy.

As we reflect on Evergrande’s precipitous fall from grace, we must evaluate our collective relationship with debt. This crisis should compel robust analysis of financial systems, corporate practices, and government policies. Are we adequately safeguarding against excessive debt accumulation? Are we equipped to handle the fallout when unsustainable debt bubbles burst?

As we navigate this complex financial landscape, we must remember that the lessons learned from Evergrande’s plight extend far beyond China’s borders. The prudent management of debt is a shared responsibility that will ultimately shape our collective economic future.